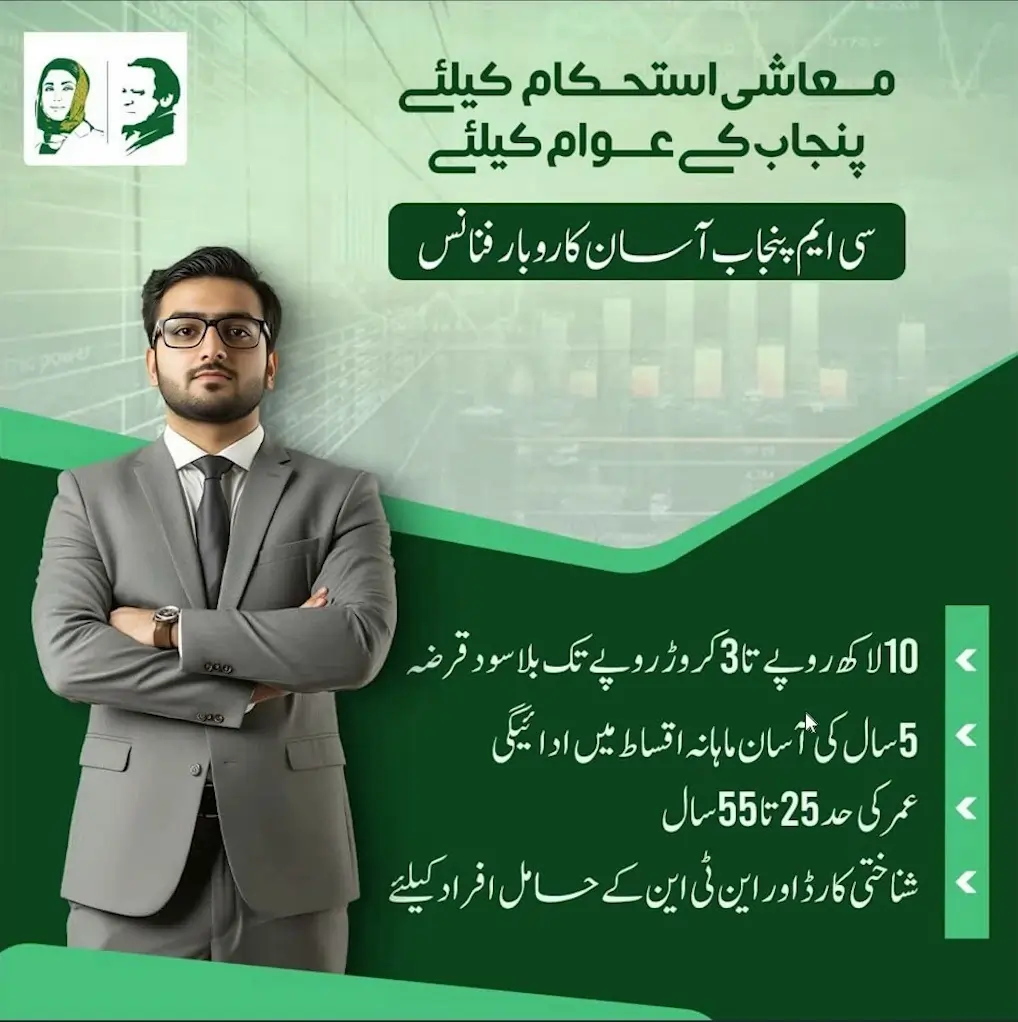

The Punjab Government is setting new benchmarks in economic development through the CM Punjab Asaan Karobar Finance Scheme 2025. This initiative is designed to empower small businesses, create job opportunities, and foster an entrepreneurial ecosystem in Punjab. This guide will provide a comprehensive overview of the scheme, its features, benefits, and application process to help aspiring entrepreneurs make the most of this groundbreaking opportunity.

What is the Asaan Karobar Finance Scheme?

The CM Punjab Asaan Karobar Finance Scheme is a financial assistance program launched by the Chief Minister of Punjab to support small and medium-sized enterprises (SMEs). This initiative provides low-interest loans to individuals with innovative business ideas, enabling them to overcome financial barriers and turn their dreams into reality.

Key Features of the Scheme

- Loan Amount: The scheme offers loans ranging from PKR 1,000,000 to PKR 30,000,000.

- Low Interest Rates: Loans are provided with an annual interest rate as low as 5%.

- Flexible Repayment Plans: Loan repayment periods extend up to 5 years, ensuring minimal financial strain.

- Asaan Karobar Finance Card: A dedicated card for quick access to loans ranging from PKR 500,000 to PKR 1,000,000.

- Solar System Support: Entrepreneurs in export processing zones can receive solar systems worth up to PKR 5,000,000.

- Simplified Application Process: Applicants can apply online through the official portal or visit help desks for assistance.

PSER Registration for Ramadan Relief Package 2025

Eligibility Criteria

To qualify for the scheme, applicants must:

- Be permanent residents of Punjab.

- Be aged between 25 and 55 years.

- Have a viable business plan.

- Be registered as active tax filers.

How to Apply for the Scheme

Step-by-Step Guide:

- Visit the Official Portal: Access the Asaan Karobar Finance Scheme’s website.

- Register an Account: Sign up using your CNIC and a mobile number registered in your name.

- Complete the Application Form: Fill out all required details, including business income and expenses.

- Upload Required Documents:

- CNIC (Front and Back)

- Passport-size photo

- Proof of residence

- Detailed business plan

- Rent agreement/transfer letter (if applicable)

- Pay Application Fees:

- Tier 1 Loan: PKR 5,000 (non-refundable)

- Tier 2 Loan: PKR 10,000 (non-refundable)

- Submit Application: Once submitted, you will receive an application registration number via SMS.

- Track Your Application: Use the portal or helpline (1786) for updates.

Financial Terms and Conditions

- Interest Rate: 5% per annum.

- Repayment Period: Up to 5 years.

- Penalties: Minimal charges for late payments to encourage timely repayment.

- Loan Security: Applicants must provide collateral such as property documents, government securities, or other assets.

Air Force Jobs 2025: Eligibility, Roles, Benefits, and Application Guide

Benefits of the Scheme

- Economic Empowerment: Provides financial resources to entrepreneurs to start or expand their businesses.

- Job Creation: Supports SMEs, indirectly creating numerous employment opportunities.

- Economic Growth: Boosts Punjab’s economy and attracts local and international investments.

- Gender Inclusivity: Encourages women entrepreneurs to apply and participate in the economic growth process.

Challenges in Implementation

- Limited Awareness: Despite its benefits, many potential beneficiaries remain unaware of the scheme.

- Documentation Errors: Common mistakes in applications delay approvals.

- Accessibility: Ensuring all applicants, especially in remote areas, can easily access the program.

To address these challenges, the Punjab Government has set up help desks and a dedicated helpline for guidance.

Role of the Punjab Government

The government has partnered with leading financial institutions to ensure smooth implementation of the scheme. By allocating significant resources and offering additional support measures such as free land allocation for industries, the initiative aims to create a thriving entrepreneurial ecosystem.

Conclusion

The CM Punjab Asaan Karobar Finance Scheme 2025 is a game-changer for aspiring entrepreneurs. By removing financial barriers and providing necessary support, the scheme is paving the way for a prosperous Punjab. Whether you are a young entrepreneur with an innovative idea or a small business owner seeking expansion, this initiative is your opportunity to shine.

Now is the time to act—apply today and take the first step toward your entrepreneurial dreams!

ASF Jobs 2025 – Vacancies, Eligibility & Application Process

FAQs

1. What is the loan range under the scheme?

Loans range from PKR 1,000,000 to PKR 30,000,000, depending on business needs.

2. Can women entrepreneurs apply?

Yes, the scheme also encourages the women entrepreneurs to apply.

3. Are there any hidden charges?

No, the scheme is transparent and there are no hidden charges.

4. How long does it take to process the application?

Typically, it takes 2 to 4 weeks for application processing.

5. What happens in case of default?

The government has a lenient policy but advises timely repayments to avoid penalties.

Pingback: Chief Minister Magnificent Tourism Internship Program 2025 - All Jobs Portal